Here’s the market outlook for the week:

EURUSD

Dominant bias: Bearish

There is a very strong Bearish Confirmation Pattern on EURUSD. Price went southwards by 100 pips last week (it has gone south by almost 750 pips since April 19). The line at 1.1650 has been tested and breached to the downside, slightly. This week, further bearish movement is a possibility, and the support lines at 1.1600 and 1.1550 can be reached as well. However, there is also a possibility of a bullish reversal before the end of the week.

USDCHF

Dominant bias: Bullish

This trading instrument is bullish in the long-term, and bearish in the short-term. Last week, price turned southwards, testing the level at 0.9900 several times and eventually closing below it on Friday. One reason why the market became bearish in the short-term is the strength in CHF. CHF still strong, as evident on major CHF pairs. The market can thus reach the support levels at 0.9850 and 0.9800, thereby erasing the long-term bullish outlook on the market.

GBPUSD

Dominant bias: Bearish

This pair went southwards last week, closing below distribution territory at 1.3300 on Friday. Price shed almost 170 pips last week, and it has shed 1,050 pips since April 17 (an ideal market condition for trend followers). The GBP remains very week, and it is not advisable to seek long trades here, except to go short on rallies. The market is expected to lose at least, additional 150 pips this week, reaching the accumulation territory at 1.3150.

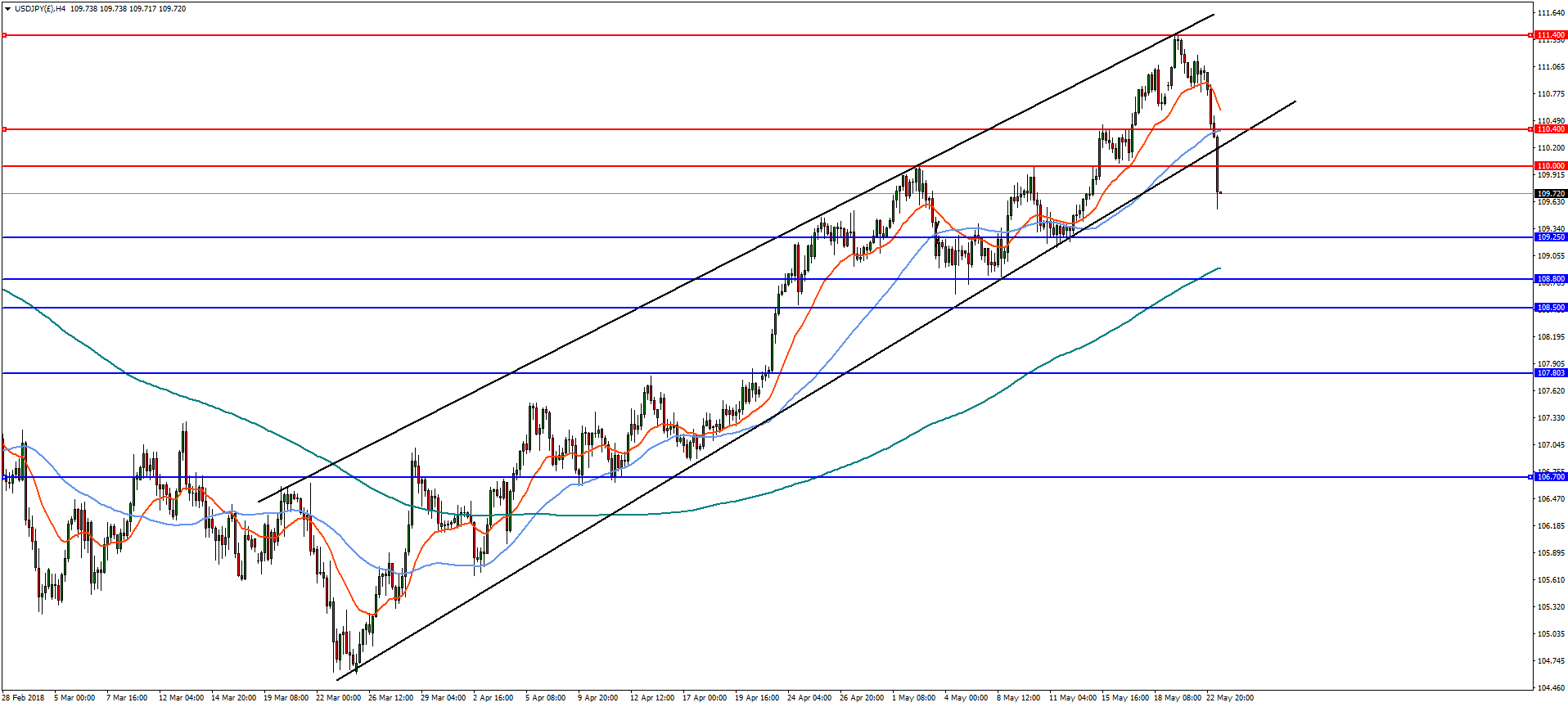

USDJPY

Dominant bias: Bullish

The trend is also bearish in the short-term, but bullish in the long-term. From the high of last week, price went downwards by 230 pips, to test the demand level at 109.00, closing above it on May 25. Further bearish movement is expected this week, and this may affect the long-term bullish bias, as the demand levels at 109.00, 108.50 and 108.00 are aimed, for there is a considerable stamina in Yen.

EURJPY

Dominant bias: Bearish

The downwards movement that happened last week has put an end to the recent sideways movement that was seen in the market. From May 9 to 22, the market consolidated in the context of a downtrend, and at last, there was a breakout in favor of sellers. This has really put more emphasis on the Bearish Confirmation Pattern in the market, coupled with the weakness in EUR. This week, the demand zones at 127.00, 126.50 and 126.00 may be reached.

GBPJPY

Dominant bias: Bearish

The bias on GBPJPY is bearish and it should continue to be bearish. GBP is weak and JPY is strong. Besides, there was a huge drop of over 450 pips last week, slashing more and more demand zones as bears rejoiced. Since April 17, more than 800 pips have been shed, and this just seems to be the beginning, as stronger bearishness is anticipated. At least, another 200 pips would be shed this week.

This forecast is concluded with the quote below:

“…Trading appeals to so many of us. It generates a sense of freedom – a notion that we can do it from anywhere at anytime. The engagement with the market is at our own timing and on our own terms. We can in essence wander in and out whenever we want. Our movement is not at the behest of someone else and it not set according to their timetable. The nomad in us is fulfilled as a trader.” – Chris Tate

Source:

www.tallinex.com