The Japanese Yen (JPY) is benefiting from risk-off sentiment today with the USD/JPY pair plunging below the 110.00 level. A number of factors are combining to trigger the move including geopolitical tensions in Iran, trade war rhetoric between US and China, political turmoil in Italy, and renewed concerns over North Korea. The US 10-year Treasury yields have also dropped sharply to 3.015%. The focus for today will be the release of latest FOMC meeting minutes, which may give clues to the central bank’s near-term monetary policy outlook. If the text reinforces the expectations for three rate hikes for 2018, the US Dollar may continue to strengthen.

USD/JPY

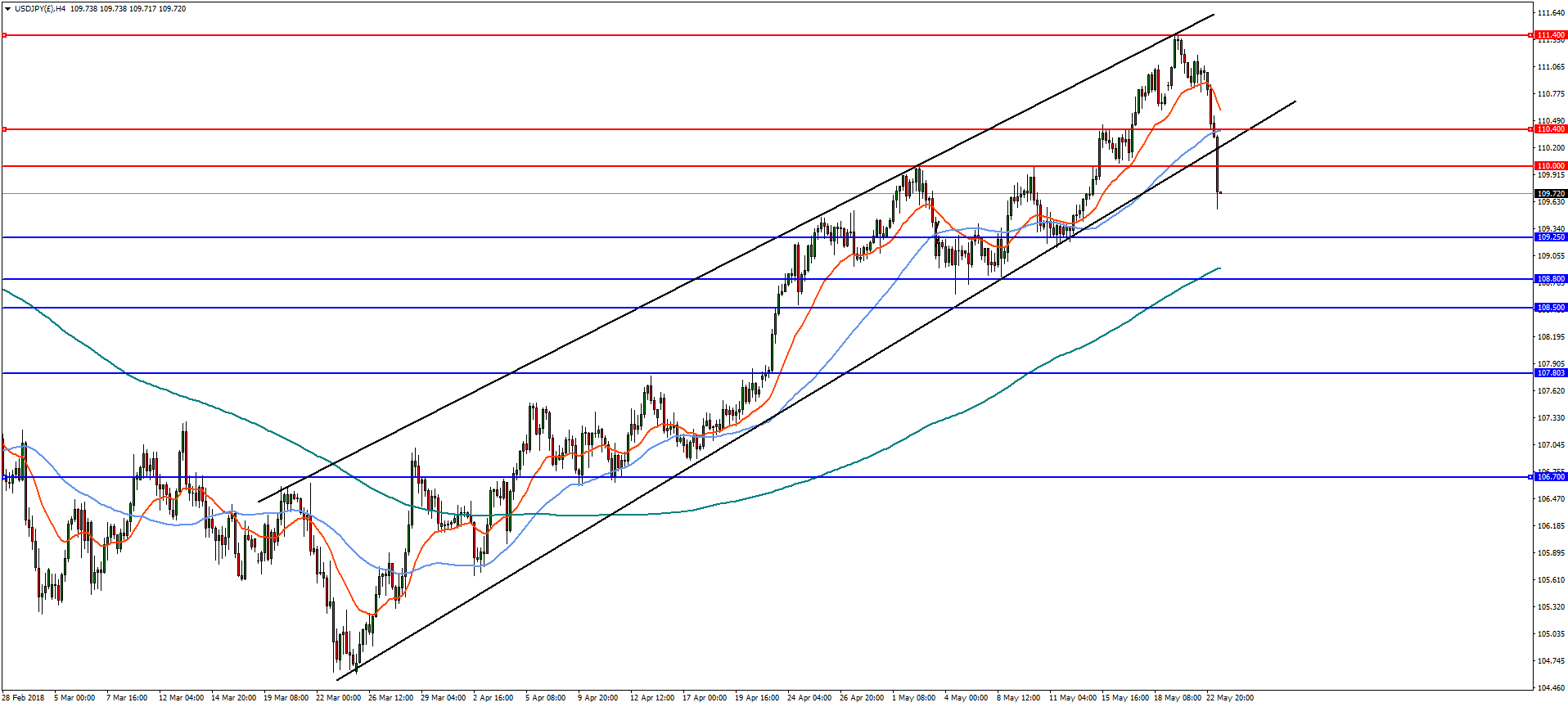

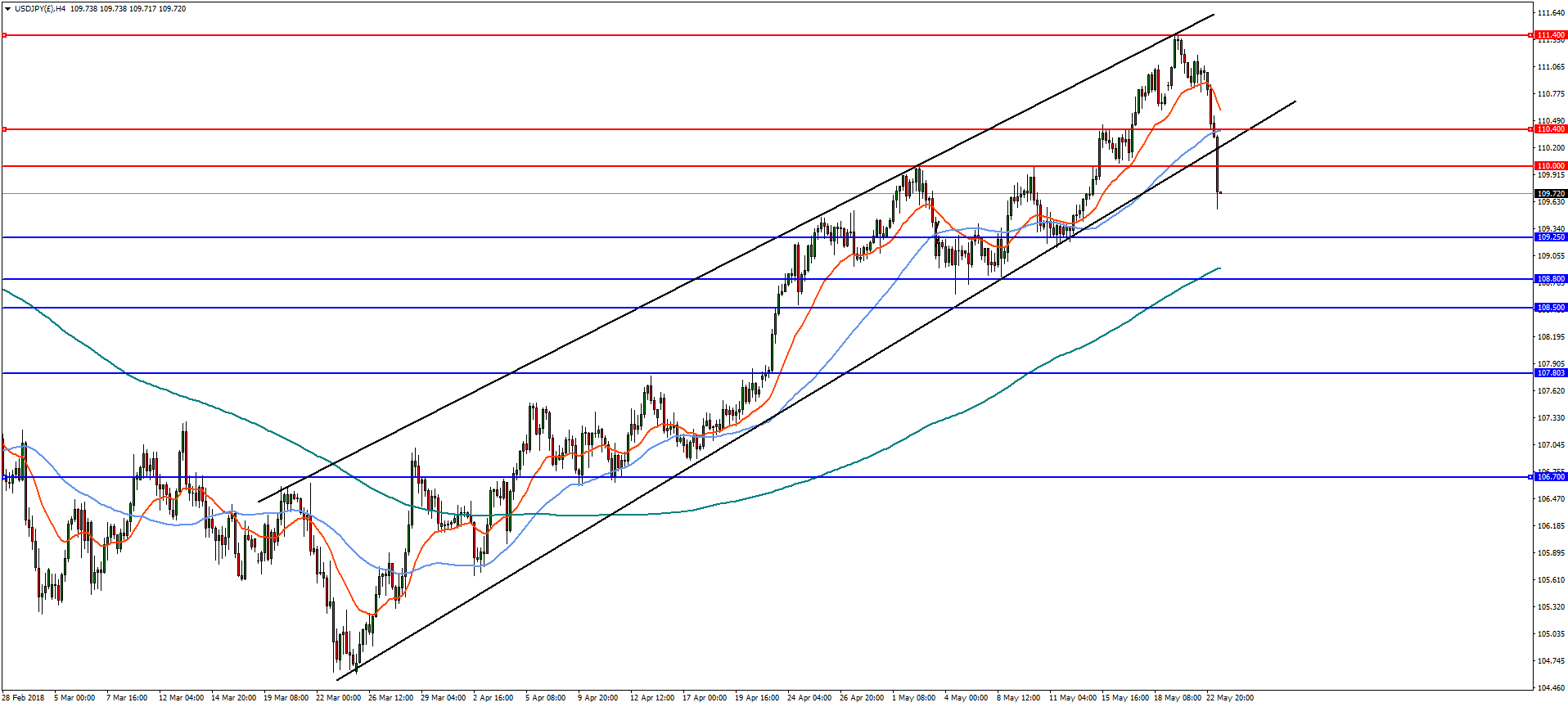

On the 4-hourly chart, yen to usd has broken channel support and a close below 110.00 opens the way to further declines towards the 38.2% retracement at 108.80 with support at 109.25. A break of 108.80 could see a deeper retracement to the 107.00 handle. A bullish reversal and break of 110.40 is needed to resume the uptrend to the highs at 111.40, now 1 jpy to usd at 0.00908.

USD/JPY

On the 4-hourly chart, yen to usd has broken channel support and a close below 110.00 opens the way to further declines towards the 38.2% retracement at 108.80 with support at 109.25. A break of 108.80 could see a deeper retracement to the 107.00 handle. A bullish reversal and break of 110.40 is needed to resume the uptrend to the highs at 111.40, now 1 jpy to usd at 0.00908.

USD/JPY has broken channel support and a close below 110.00

Aucun commentaire:

Enregistrer un commentaire